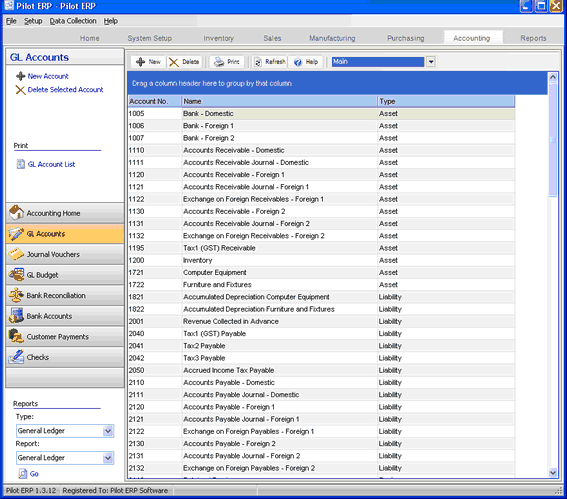

Accounting menu.

The GL Accounts screen displays accounts in a list showing account no., name, and type.

Your GL accounts are often referred to as your chart of accounts. They are used to record revenue and expenses, and the increases and decreases of your assets, liabilities and owner's equity.

GL account numbers are comprised of the main account and 3 optional subaccounts, which can be used for branch, division, department, project, product group or whatever. These don't have to be built into the main GL account number. So for data entry, when selecting the main account (responsibility) you don't have to scroll past all the various subaccounts. Nor do you have to set up every combination of main and subs that will occur. And financial statements can be run for selected subaccounts without having to set up separate statement formats. For example an income statement (profit and loss) for product group "Frozen Pies", and/or division "West", etc. Or select no subs to get a summary consolidated report.

GL account numbers and names displayed on reports and non-entry screens are comprised of the main account and subaccounts separated by hyphens (-).

For example: 1200-10-95-1 Inventory - Department Ten - Frozen Pies - West

A subaccount can apply to any GL account, not just one. So for example, a business that sells musical instruments could have a subaccount for instrument type: drums, guitars, keyboards. Revenues and expenses could then be tracked by instrument type and this would facilitate financial statements by type (drums only, guitars only) or summarized (all instrument types) using the same financial statement and selecting instrument type when they select the report. So they could see the profitabillity of the drums side of the business, or guitars, etc. The same could apply to department, branch, division, project, etc.

So instead of just main accounts:

4000 Sales

5000 Cost of Goods Sold

5126 Advertising

You could use a subaccount for instrument type:

10 Drums

20 Guitars

30 Keyboards

And therefore the following GL accounts would be possible:

4000-10 Sales - Drums

4000-20 Sales - Guitars

4000-30 Sales - Keyboards

5000-10 Cost of Goods Sold - Drums

5000-20 Cost of Goods Sold - Guitars

5000-30 Cost of Goods Sold - Keyboards

5126-10 Advertising - Drums

5126-20 Advertising - Guitars

5126-30 Advertising - Keyboards

Where 4000, 5000, and 5126 are main accounts and 10, 20, and 30 are subaccounts. Note: Each subaccount only has to be defined once (not for every account) and can be used for any GL account.

On the GL Accounts screen toolbar there is a combobox to select Main or Subaccount1, 2, or 3. You can use this to change the list to show subaccounts and the New, Edit, Delete buttons to apply to subaccounts rather than the main account.

To add a new account: click the New button. Or menu Records | New.

To edit an account: double-click the account. Or select the account and press Enter or click the Edit button. Or menu Records | Edit.

To delete an account: select the account and click the Delete button. Or menu Records | Delete.

You can select an account with the mouse or by the keyboard via the Page Up/Down and arrow keys. Or click the Find button, then enter the account no. or select the account name from the drop down list. Tip: You can enter the 1st letters of the account name then press the down arrow.

The menu has options to

| • | filter the list by specifying selection criteria such as type (asset, liability, etc.) |

| • | sort the list by account no. or name |

| • | display totals for a selected account |

| • | display history (transactions) for a selected account |

| • | refresh the data displayed to show changes entered by other users, etc. |

| • | print the list |

Tip: To display totals or history for an account: select the account, then right-click to display a pop-up menu.

GL Account Types

Sample Chart of Accounts

Account no.

Accounts can be accessed by number or name. The financial statements print summarized data based on user-defined ranges of account numbers. Therefore it is convenient, though not essential, for account numbers to be assigned in ranges.

Example: 5110 Auto Supplies, 5111 Office Supplies, 5112 Courier, 5113 Telephone, etc.

Note: You can change the account number and the history will automatically still be linked to the account, but you will have to adjust the account ranges on the financial statements.

Suspended

Check here to prevent further transactions from being entered for this account.

Name

The account name.

Example: Charitable Donations

Type

Account Type: Asset, Liability, Revenue, Expense, or Equity.

On the equity account that is used for prior years retained earnings, check the Retained Earnings checkbox. At year-end the program will move the net of revenues and expenses to this account. Current year retained earnings is not a separate account.. it is the net of the current year revenue and expense accounts.

Notes

Enter any notes you wish to record here.