Accounting menu.

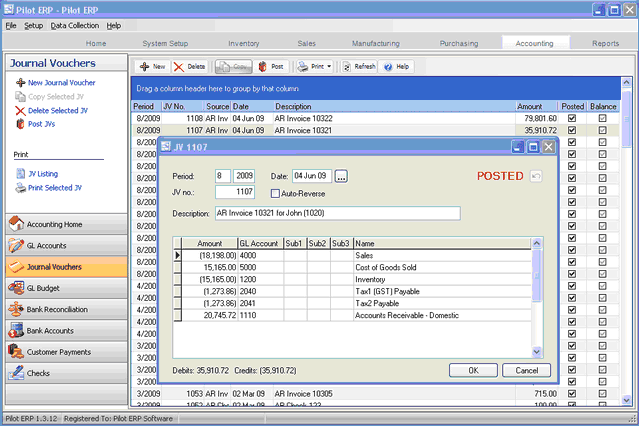

The Journal Vouchers screen displays JVs in a list showing summary info including period, JV no., source, description, date, and amount.

Data is passed to the GL system from the AP and AR automatically via Journal Vouchers with expenses and revenues converted from foreign currency to domestic currency. "You can trade globally in multiple currencies while your books remain in domestic currency".

Data is keyed directly to the GL system via Journal Vouchers to record

| • | initial entry of opening balances |

| • | bank charges and interest |

| • | depreciation |

| • | corrections and adjustments to previous GL transactions |

| • | purchase of foreign currency |

| • | foreign currency AP, AR, and bank balances conversion to domestic currency |

See Examples of Journal Vouchers.

To add a new Journal Voucher: click the New button.

To edit a Journal Voucher: double-click the JV. Or select the JV and press Enter or click the Edit button.

To delete a Journal Voucher: select the JV and click the Delete button.

You can select a Journal Voucher with the mouse or by the keyboard via the Page Up/Down and arrow keys. Or click the Find button, then enter the JV no and/or period. Selecting the JV only will find the 1st JV with that JV number. Selecting the period only will find the 1st JV in that period. Selecting JV no. and period will search on both.

The menu has options to

| • | filter the list by specifying selection criteria such as source (AP Invoices, AR Payments, GL JVs, etc.) |

| • | sort the list by period or JV no. |

| • | copy a JV (all data except JV no., date and period, which default as per a new JV) |

| • | refresh the data displayed to show changes entered by other users, etc. |

| • | print the list |

| • | print a selected JV |

| • | post JVs (see notes following) |

Journal vouchers are entered, then posted. Prior to posting, they may be edited or deleted. Posted JVs (except those from prior years or automatically created by AP or AR) can be unposted from the “Edit” screen if they need to be edited or deleted. Posting updates account totals and GL history. To post JVs use menu Records | Post or choose the Post option when closing the JVs screen.

Journal vouchers are also automatically created by posting AP invoices, AP Checks, AR invoices, and AR payments. These JVs must also be posted in the GL system. Posting these JVs is separate job because in a multi-user environment it is possible for this to conflict with other GL jobs such as printing financial statements. This minimizes the chance of the AP and AR posting jobs being unavailable. JVs created by other systems cannot be modified or deleted even prior to posting in the GL.

Period

This is the fiscal period and year of the journal voucher. This defaults to the current calendar month, or the default period on Your Company if specified there. If your fiscal year doesn’t end in December or your fiscal periods are not calendar months, you should set the default period regularly to help prevent data entry errors. Note: The year is entered as 2 digits and displayed as 4.

Example: 11 2001 entered as 11 01

Date

The transaction date defaults to today’s date.

Tip: You can use the + or - keys to increase or decrease the date, or click the 3-dots button to select the date from a calendar.

JV no.

The journal voucher number is used to identify the journal voucher, and shows on the GL History screen and on the General Ledger Report. When entering a new JV, the program assigns a default JV number which you can then change if desired.

Auto-Reverse

An auto-reversing JV is actually 2 JVs: you enter it as 1 JV but it is as if you entered two. You enter it as 1 JV with the Auto-Reverse checkbox checked. Then when you post it, it goes into the system as 2 JVs: one as you entered it, and another to the next period with the opposite amounts hitting the GL accounts. This saves you the bother of having to enter 2 JVs. Alternatively you could enter 2 JVs and ignore the "Auto-Reverse" feature.

An example of when you would reverse a JV in the next period is an "accrual", such as when you have received inventory but not yet received the AP invoice. You want the financial statements to reflect that you owe money, and you want to reset the books after the financial statements are printed (ie. in the next period) since the invoice will eventually arrive.

Another example is the period-end conversion of foreign currency balances (such as foreign money in the bank, or receivables, or payables, etc.), where you want the foreign currency balances to show in domestic currency on the financial statements. Then you want the foreign balances reset back to the foreign currencies after the financial statements are printed (after period-end).

Description

The transaction description shows on the GL History screen and on the General Ledger Report.

Example: To record depreciation

Amounts and GL Accounts

Enter the amount for each GL account. Debits are keyed as positive numbers and credits are keyed as negative numbers.

Expense accounts are normally debits. Example: $100 (expense incurred)

Revenue accounts are normally credits. Example: -$100 (revenue earned)

Asset accounts are normally debits. Example: $100 (money in bank)

Liability accounts are normally credits. Example: -$100 (money owed)

The total debits must match the total credits.

Example: total debits = $200 and total credits = -$200

Tip: You can display a pop-up menu with options for New (line) and Delete (line) by right-clicking on the grid.

GL account numbers are not entered directly on the JV screen, but instead selected on pop-up screens which display if you type into the account number columns: main account and optional subaccounts (if used), or by clicking on the “3 dots” button in the columns, double-clicking in the columns, or by the keyboard shortcut Ctrl+Enter.

On the GL Account or Subaccount pop-up screen: you can select the account by typing the account number in the 1st entry box or by typing the name in the 2nd box, or by selecting the account with the mouse or up/down arrow keys. Click on the selected account or press Enter when the selected account is highlighted. Or Esc to leave a previously entered account unchanged.

Typing the account number in the 1st entry box sorts the list by account number and selects the first account number matching the characters entered.

Typing the account name in the 2nd entry box sorts the list by account name and selects the first account name matching the characters entered.

On the GL Account (main) pop-up screen you can select account type (revenue or expense, etc.) via the combobox at the right, so that only accounts of the selected type show. To deselect an account type and show all types, press Delete.

On the Subaccount pop-up screen there is a checkbox to allow deselecting a subaccount since subaccounts are optional. Checked = subaccount used. Unchecked = no subaccount. This is automatically checked when a subaccount is selected. To clear a previously selected subaccount: uncheck the checkbox and press Enter.