Accounting Menu

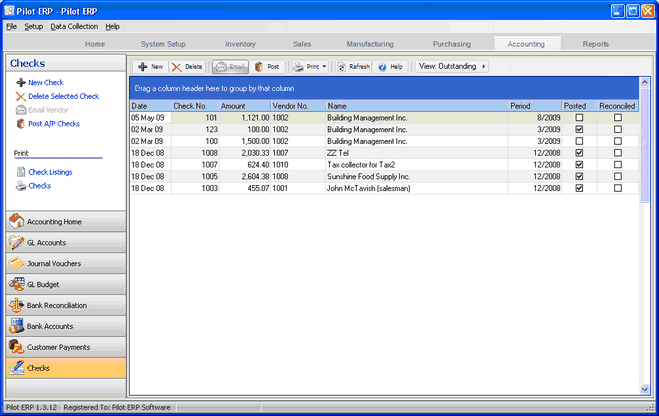

The AP Checks screen displays Checks (checks) in a list showing summary info including check date, vendor, check no., and amount.

Checks can be entered manually or created automatically using the “Single Check” and “AutoCreate Batch” options. AutoCreate Batch automatically creates Checks based on selected currency, vendor, due date, check date, and period. These can later be modified or deleted prior to printing and posting. With “Single Check” you select the vendor and then select which invoice(s) to pay.

Checks are entered for invoices that have been previously entered to the system. If there was no invoice, you should create a dummy invoice using the check no.

To add a new check or AutoCreate Checks: click the New button.

To edit a check: double-click the check. Or select the check and press Enter or click the Edit button.

To delete a check: select the check and click the Delete button.

You can select a check with the mouse or by the keyboard via the Page Up/Down and arrow keys. Or click the Find button, then enter the vendor no. or select the vendor name from the drop down list, and/or enter the check no. Selecting the vendor only will find the 1st check for that vendor. Selecting the check only will find the 1st check with that check number. Selecting vendor and check no. will search on both.

The screen has options to:

| • | display outstanding (not reconciled) Checks only |

| • | sort the list by check date, check no. or any other field in the grid |

| • | display the vendor for a selected check |

| • | refresh the data displayed to show changes entered by other users, etc. |

| • | print the list |

| • | print Checks |

| • | reconcile or un-reconcile the selected check (see notes following) |

| • | post printed Checks (see notes following) |

Tip: To e-mail the vendor (via your e-mail program), or display the vendor, or reconcile the check: select the check, then right-click to display a pop-up menu.

AP Checks are entered, printed, then posted. Prior to posting, they may be edited or deleted. Posted Checks cannot be edited or deleted, so to cancel a check after it has been posted (which would be a very unlikely requirement), you would need to re-enter the invoice(s), and adjust the bank and expense accounts by GL Journal Voucher. Posting updates vendor balances, invoice balances, and creates general ledger journal vouchers to update the GL account totals and GL history.

To post Checks use menu Records | Post or choose the Post option when closing the Checks screen. Posting the JVs is a separate job because in a multi-user environment it is possible for this to conflict with other GL jobs such as printing financial statements. This minimizes the chance of the AP posting job being unavailable. JVs created by the AP system cannot be modified or deleted even prior to posting in the GL.

Note: Checks must be printed prior to posting. Hand-written Checks should have the check number entered. Presence of a check number indicates that the check has already been printed or hand-written.

To print Checks use menu Print Checks. Then select the bank and the program will display how many Checks will be printed (check number blank, not yet printed). Choose OK or Cancel. If you choose OK, the program will ask for the check number of the 1st check. Enter this and press OK. The program will then print the Checks with the appropriate check number on each check.

Checks can be ordered on-line through our website or by searching for Quickbooks™ compatible checks with your preferred business forms provider.

Check Styles: option located in the Your Company | AP Options section of the system setup.

Format 1 is designed for all US and foreign companies except Canada.

Format 2 is designed specifically to accommodate the CPA standards.

Tip: To print a cash requirement report prior to printing Checks (a list of Checks that will be printed with the total amount of money required) you can use the filter button, then menu File | Print.

To reconcile Checks (i.e. denote that they have appeared on a bank statement) use the Records menu or the pop-up menu available via the right mouse button. When doing this you should first sort the list by check no. via menu View. Also you may find it more convenient to view only “outstanding” (not reconciled) Checks by toggling the option on menu View or using the shortcut Ctrl+O.

Check Creation

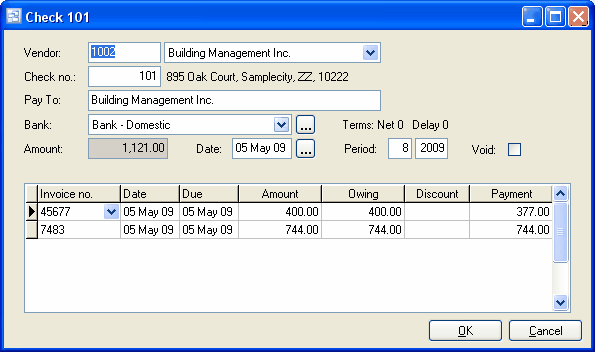

Vendor

A pop-up screen displays if you type into the vendor number, click, or by the keyboard shortcut Ctrl+Enter. On the Vendor pop-up screen: you can select the vendor by typing the vendor number in the 1st entry box or by typing the name in the 2nd box, or by selecting the vendor with the mouse or up/down arrow keys. Click on the selected vendor or press Enter when the selected vendor is highlighted. Or Esc to leave a previously entered vendor unchanged.

Typing the vendor number in the 1st entry box sorts the list by number and selects the first vendor number matching the characters entered. Typing the vendor name in the 2nd entry box sorts the list by name and selects the first vendor name matching the characters entered.

On the Vendor pop-up screen you can select Vendor Type via the combobox at the right, so that only vendors of the selected type show. To deselect a vendor type and show all types, press Delete.

Check no.

If the check was hand-written (or typed), then enter the check number. Otherwise for computer printed Checks, leave the check number blank and the program will enter it when the Checks are printed. Presence of a check number indicates that the check has already been printed or hand-written.

Bank

The bank (account) defaults to the 1st bank whose currency matches the vendor. This applies to auto-created Checks and manually entered Checks. Select the bank from the list if it should be changed. If you need to add a new bank to the drop down list, click the “3 dots” button.

Tip: You can enter a few characters of the bank name, then use the down or up arrow keys if required.

Check Amount

The check amount is calculated by the program (rather than keyed), based on the invoice payment amounts.

Check Date

The check date defaults to today’s date.

Tip: You can use the + or - keys to increase or decrease the date, or click the 3-dots button to select the date from a calendar.

Period

This is the fiscal period and year of the check (not the period to which the expense should be applied, which is based on the invoice). This defaults to the current calendar month, or the default period on Your Company if specified there. If your fiscal year doesn’t end in December or your fiscal periods are not calendar months, you should set the default period regularly to help prevent data entry errors. Note: The year is entered as 2 digits and displayed as 4.

Example: 11 2001 entered as 11 01

Void

Check the void checkbox if recording a void check, such as when a check form is messed up by the printer and you want to record in the system that the form with this check number was used legitimately. Then if you find you have any missing check numbers, this may indicate that check forms have been stolen.

If there are so many invoices for a check that multiple stubs are required, then the program will print ***VOID*** on the unused check forms. If you are recording these void Checks, you enter them as new Checks, and enter the check number, bank, and check the Void checkbox.

If recording a void check that was messed up by the printer, the check record will already exist, so you edit it. Note: You must do this before posting, since posted Checks cannot be edited. Remove the vendor and invoices (Ctrl+Del or display pop-up menu by right-clicking on the grid), and check the Void checkbox.

Voiding a check is not the same thing as cancelling a posted check (see above for how to do this).

Invoices to be paid

Select each invoice to be paid and the payment amount for each invoice. This defaults to the amount owing minus any discount if eligible. If this is the amount you want to pay, use the down arrow or PageDown to move to the next line, otherwise press Enter on the invoice no. field to move directly to the payment amount, where you can enter the partial payment amount.

The check amount will be updated when you move to the next line, or the OK button, etc.

Tip: You can display a pop-up menu by right-clicking on the grid.