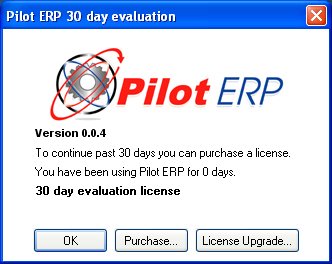

When Pilot ERP is started for the first time a welcome screen displays.

You can choose to look at a sample company first, which is a quick way to explore Pilot ERP. This screen displays every time you start Pilot ERP until you choose purchase Pilot and set up your own company. Note: You can still select the sample data company or set up more companies from menu File | Companies.

When you choose to set up your own company, a New Company Wizard will assist you to enter the basic information required to use Pilot ERP.

The wizard adds a sample chart of accounts, and sets up 1 bank, 1 currency, and 1 sales tax. You can then add, modify, or delete GL accounts to suit the needs of your company. You can also add more bank accounts, currencies and taxes.

The wizard also sets up 1 warehouse “Our Warehouse” for the inventory. And again, you can add more, if required, when you are ready.

After setting up any additional banks, currencies, taxes, etc. your next step is to enter your vendors, customers, and items.

You are now ready to use the Home Page, Accounts Payable, Accounts Receivable, General Ledger, Inventory, Purchase Orders, Sales Orders, and Manufacturing.

You can enter any outstanding invoices for your vendors via AP Invoices, and enter any outstanding invoices for your customers via AR Invoices. Or you might find it easier to pay all your AP invoices now from your old system (whether you mail the Checks now is up to you), and use your old system to track money owed to you from customers. Then you only need to enter the total AR amount owing (by JV to Accounts Receivable Journal as per the sample data, see JV no. 1001), and the payments (by JV, see JV no. 1015 To record AR payments entered to old system).

GL opening balances are entered by Journal Voucher. There is an example in Examples of Journal Vouchers and a more detailed, multi-currency example in the sample data. Typically this JV is entered to last period, with data from the trial balance report for last period. Alternatively if you prefer the opening balances to show in the “opening balance” fields for this year, then you would enter the JV to the last period of last year, and then run the year-end from the Your Company screen. Note: To do this you need to enter the Fiscal Year as last year on Your Company before entering any JVs.