Located under the Purchasing Menu.

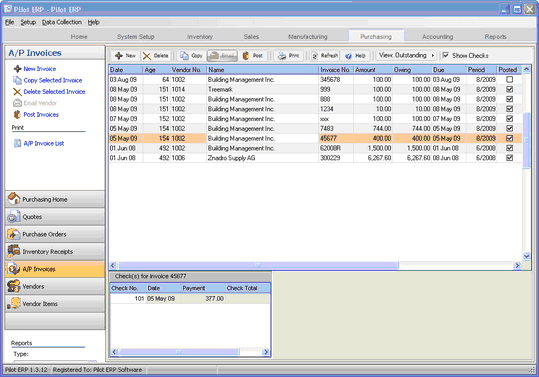

The AP Invoices screen displays invoices in a list showing basic invoice info including invoice date, vendor, invoice number, amount, balance owing, and due date.

To add a new invoice: click the New button.

To edit an invoice: double-click the invoice. Or select the invoice and press Enter.

To delete an invoice: select the invoice and click the Delete button or right click and select delete.

You can select an invoice with the mouse or by the keyboard via the Page Up/Down and arrow keys. You may also search any column by first clicking on it, then typing in the item you are searching. The grid will automatically drill down based on your entry.

The check payments for each invoice will optionally display at the bottom of the screen. To open and review the check(s), simply double click on the check number.

The menu has options to

| • | display outstanding (unpaid) invoices only |

| • | sort the list by invoice date, due date, invoice no., vendor, amount or any other field in the grid |

| • | copy an invoice (all data except invoice no., PO, date and period, which default as per a new invoice) |

| • | display the vendor for a selected invoice (right click on invoice) |

| • | display Checks for a selected invoice |

| • | refresh the data displayed to show changes entered by other users, etc. |

| • | print the list |

| • | export to Excel or comma delimited text |

| • | post invoices (see notes following) |

Tip: To send an e-mail to the vendor (via your e-mail program), or display the vendor: select the invoice, then right-click to display a pop-up menu.

AP invoices are entered, then posted. Prior to posting, they may be edited or deleted. To undo an invoice after posting, you must “reverse” it by selecting the reverse option (right click or option on left toolbar). You can then remove the invoice by deleting or you may edit and re-post. Posting updates vendor balances and creates general ledger journal vouchers to update the GL account totals and GL history.

To post invoices use menu Records | Post or choose the Post option when closing the invoices screen. Posting the JVs is a separate job because in a multi-user environment it is possible for this to conflict with other GL jobs such as printing financial statements. This minimizes the chance of the AP posting job being unavailable. JVs created by the AP system cannot be modified or deleted even prior to posting in the GL.

To view only “outstanding” (unpaid) invoices sorted by due date, toggle the outstanding option on the top menu.

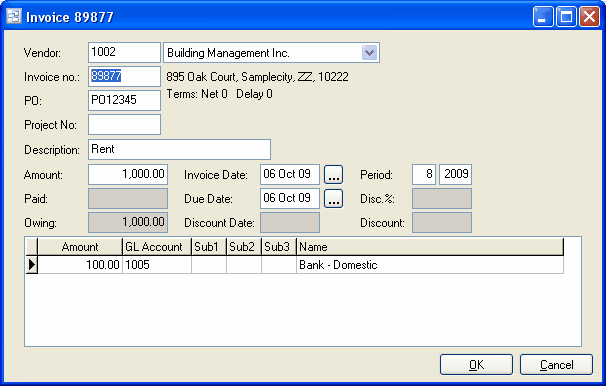

AP invoice Entry

Field Descriptions

Vendor

A pop-up screen displays if you type into the vendor number, click, or by the keyboard shortcut Ctrl+Enter. On the Vendor pop-up screen: you can select the vendor by typing the vendor number in the 1st entry box or by typing the name in the 2nd box, or by selecting the vendor with the mouse or up/down arrow keys. Click on the selected vendor or press Enter when the selected vendor is highlighted. Or Esc to leave a previously entered vendor unchanged.

Typing the vendor number in the 1st entry box sorts the list by number and selects the first vendor number matching the characters entered. Typing the vendor name in the 2nd entry box sorts the list by name and selects the first vendor name matching the characters entered.

On the Vendor pop-up screen you can select Vendor Type via the combobox at the right, so that only vendors of the selected type show. To deselect a vendor type and show all types, press Delete.

If this is a new vendor, click the 3-dots button to display the vendors screen, so the vendor can be added.

Invoice no.

Enter the invoice number from the vendor’s invoice.

Purchase Order no.

Enter the purchase order number from the vendor’s invoice (if desired).

Tip: If your company’s policy is not to enter purchase order numbers, you can prevent this field from displaying via an option on Your Company.

Project No.

If this purchase was part of a Project, enter the project number here.

Description

Enter a description for this purchase (if desired). This defaults to the vendor default invoice description.

Tip: If your company’s policy is not to enter invoice descriptions, you can prevent this field from displaying via an option on Your Company.

Amount

Enter the invoice amount from the vendor’s invoice (which will be in the currency defined for this vendor).

Paid

This is the amount paid so far and is read-only. Payments are entered via AP Checks.

Owing

This is the amount owing and is read-only. It is the original invoice amount minus any payments and discount taken.

Invoice Date

Enter the invoice date from the vendor’s invoice, or today’s date depending on your company’s policy. The invoice date defaults to today’s date. The default due date will be based on the invoice date and the vendor’s terms.

Tip: You can use the + or - keys to increase or decrease the date, or click the 3-dots button to select the date from a calendar.

Period

This is the fiscal period and year of the invoice, the period to which the expense should be applied. This defaults to the current calendar month, or the default period on Your Company if specified there. If your fiscal year doesn’t end in December or your fiscal periods are not calendar months, you should set the default period regularly to help prevent data entry errors. Note: The year is entered as 2 digits and displayed as 4.

Example: 11 2001 entered as 11 01

Due Date

This is the date when the invoice becomes eligible for payment if using the AutoCreate feature on the AP Checks. However invoices can be paid anytime if the “manual” option is selected instead of AutoCreate. The default due date is based on the invoice date and the vendor’s terms (default number of days to due date).

Tip: You can use the + or - keys to increase or decrease the date, or click the 3-dots button to select the date from a calendar.

Discount %

This defaults to the vendor’s terms (discount %). If this doesn’t match the terms on the invoice, either change it here or click the 3-dots button beside the vendor name to display the vendors screen, so the new data can be entered. Note: If no discount is specified on the vendor, this field will be read-only on the invoice.

Discount Date

The discount date is based on the invoice date and the vendor’s terms (discount days) and is read-only. If the invoice is paid on or before this date, the discount (if any) will be taken.

Discount

The discount amount is based on the invoice amount and discount %, and is read-only. If the invoice is paid on or before the discount date, the discount (if any) will be taken.

Amounts and GL Accounts

Enter the amount for each GL account. The sum of the GL amounts must equal the invoice amount, otherwise an error message displays. This is to ensure the GL amounts are entered correctly.

If the invoice has GST or VAT tax, enter the total GST or VAT to the GL account for "GST/VAT Receivable" (called "receivable" since you receive a credit from the government). Other non-refundable taxes, such as PST, should be pro-rated and combined with the purchase cost of the products or services and entered to those expense or inventory GL accounts.

Tip: You can display a pop-up menu with options for New (line) and Delete (line) by right-clicking on the grid.

GL account numbers are not entered directly on the invoice screen, but instead selected on pop-up screens which display if you type into the account number columns: main account and optional subaccounts (if used), or by clicking on the “3 dots” button in the columns, double-clicking in the columns, or by the keyboard shortcut Ctrl+Enter.

On the GL Account or Subaccount pop-up screen: you can select the account by typing the account number in the 1st entry box or by typing the name in the 2nd box, or by selecting the account with the mouse or up/down arrow keys. Click on the selected account or press Enter when the selected account is highlighted. Or Esc to leave a previously entered account unchanged.

Typing the account number in the 1st entry box sorts the list by account number and selects the first account number matching the characters entered.

Typing the account name in the 2nd entry box sorts the list by account name and selects the first account name matching the characters entered.

On the GL Account (main) pop-up screen you can select account type (revenue or expense, etc.) via the combobox at the right, so that only accounts of the selected type show. To deselect an account type and show all types, press Delete.

On the Subaccount pop-up screen there is a checkbox to allow deselecting a subaccount since subaccounts are optional. Checked = subaccount used. Unchecked = no subaccount. This is automatically checked when a subaccount is selected. To clear a previously selected subaccount: uncheck the checkbox and press Enter.