Purchase Orders | Receipts

The inventory receipts screen displays receipts in a list showing summary info including receipt date, receipt no., purchase order no., vendor, warehouse, and period.

Receipts are entered against previously entered purchase orders.

For info on how purchasing and receipts of inventory relate to inventory and general ledger please see Inventory Overview.

To add a new receipt: click the New button.

To edit a receipt: double-click the receipt. Or select the receipt and press Enter or click the Edit button.

To delete a receipt: select the receipt and click the Delete button.

You can select a receipt with the mouse or by the keyboard via the Page Up/Down and arrow keys. Or click the Find button, then enter the receipt no.

The menu has options to

| • | filter the list by specifying selection criteria such as vendor, warehouse, and PO. |

| • | sort the list by receipt date (descending), receipt no., or purchase order no. |

| • | display the vendor for a selected receipt |

| • | refresh the data displayed to show changes entered by other users, etc. |

| • | print the list |

| • | post receipts (see notes following) |

Tip: To phone the vendor, or send e-mail (via your e-mail program), or display the vendor: select the receipt, then right-click to display a pop-up menu.

Inventory receipts are entered, then posted. Prior to posting, they may be edited or deleted. To undo a receipt after posting, you must “reverse” it (enter it again with the opposite amount). Posting updates the quantity received on the purchase order detail lines, and changes the order status to “completed” if the order was fully received. You can also change the status yourself if there are to be no more receipts, or you can mark specific items on the order as completed if no more is to be received. Posting also updates inventory totals, history, and item costs. To post receipts use post button on the top menu or choose the Post option when closing the receipts screen.

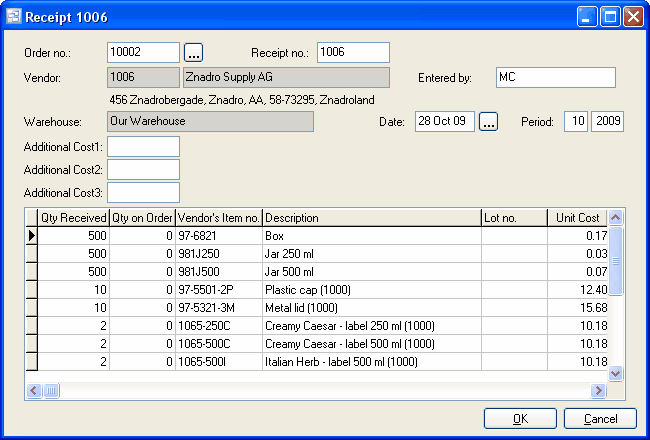

Order no.

Enter the purchase order number or click the 3 dots button to display a pop-up screen showing all the outstanding (on order) orders. You can select a vendor so that only orders for that vendor will show. To deselect the vendor press the delete key. To choose an order from the list, click on it or select it and press Enter.

When you enter the order number, data from the order will display, such as vendor name and address. Some order data will be used as defaults for the receipt, such as quantities received and unit costs.

Receipt no.

The receipt number is used to identify this transaction. When entering a new receipt, the program assigns a default receipt number which you can then change if desired.

Vendor

The vendor no., name, and address for the selected order is displayed. Verify that this is correct, to help verify that the correct order no. was entered.

Warehouse

The warehouse for the selected order is displayed. Verify that this is correct, to help verify that the correct order no. was entered.

Receipt Date

The receipt date defaults to today’s date.

Tip: You can use the + or - keys to increase or decrease the date, or click the 3-dots button to select the date from a calendar.

Period

This is the fiscal period and year of the receipt. This defaults to the current calendar month, or the default period on Your Company if specified there. If your fiscal year doesn’t end in December or your fiscal periods are not calendar months, you should set the default period regularly to help prevent data entry errors. Note: The year is entered as 2 digits and displayed as 4.

Example: 11 2001 entered as 11 01

Items, Quantities, Lot Numbers, and Costs

The quantity received defaults to the quantity on order for each item. Make changes if required. The resulting quantity on order after this receipt is displayed in the “Qty on Order” column. The unit costs (in the vendor’s currency) and item override descriptions also default to what was entered on the order, and you can override these here too. The program will convert the cost to domestic currency if required when updating the inventory history and calculating the new item cost.

Non-refundable taxes, such as PST, should be pro-rated and included in the unit cost. Whereas refundable taxes (where you get a credit from the government), such as GST and VAT, should be excluded.

Lot number is optional.

Tip: You can display a pop-up menu by right-clicking on the grid.